|

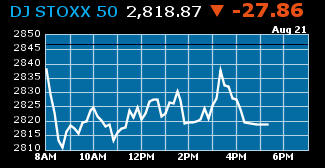

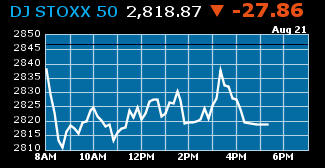

| Source: http://www.bloomberg.com/, accessed 8/21/2008 at 6:11 PM EST |

|

|

Professors: Ann Witte & Saundra Gulley |

Office Hours: 2-2:40PM & 4-5PM M&Th |

|

Phone: 781 283-2163 |

Office: 401 Pendleton East |

| E-Mail: Econ223-Ask-Ann- Saundra |

Web Page: www.wellesley.edu/Economics/witte |

What Will You Learn?

|

|

Human Capital-Rewards, Risks & How You Get Paid |

A college education is a "human capital" investment, but it can also be fun. It can help you to enjoy your life to its fullest and to be a better parent. When you decide which courses to take and what to major in your are making both an investment and a consumption decision.

Human capital investments like financial investments have both risks & rewards. When making a human capital investment, you would be wise to consider both the risks and rewards of the investment? You should also check out what credentials and experience you need for any job that you would like?

Many of your want to work in the financial industry. You probably know that some people make a lot of money in finance. Did you know that the incomes of people working in finance vary a great deal. Professions like finance are call high-risk, high-return professions.

You will learn how to assess the human capital investments you make in the course of life, including how to estimate monetary returns and how to think about intangible returns. You will examine the impact of important changes such as globalization on the returns to your human capital investments.

The monetary returns that you recieve by using your human capital will come in many forms. The most obvious is a paycheck. However, you pay may come in the form bonuses, stock options or profits if you are self employed. Benefits (e.g., health insurance, retirement plans) can account for as much as a third of your return to human capital (called total compensation).

How to insure yourself against the downsides of life

How can you insure yourself against accidents, theft (including fraud), natural disaster (e.g., fires, floods), economic instability, illness and disability, old-age and death? In some cases governments provide insurance (e.g., insurance on bank deposits, unemployment insurance, Social Security), in some cases your employer will provide insurance (e.g., health, disability, old age & life insuarnce) and in some cases you will have to purchase your own insurance (e.g., automobile insruance, homeowners insurance, liability insurance). Government may require that you buy certain types of insurance (e.g., Social Security, automobile insurance).

Insuring yourself against the downsides of life will cost money. Insurance costs are an important part of your budget.

What types of insurance should you buy? Who should you buy insurance from? Did you know that financial markets as well as insurance companies can provide you with insurance? Hedging is one way of insuring.

For what risks should you self insure? Did you know that most Californians don't have earthquake insurance? Why?

Taxes are not discretionary. They are deducted from your paycheck!

Did you know that many US taxpayers pay 40% or more of their income in taxes and that citizens of many other countries pay even more? Given the US deficit & the dire situation of many state & local governments (think CA), it is likely that taxes will be even higher in the future.

Taxes are likely to be one of your biggest "expenditure" items. They are not discretionary. Most taxes will be withheld from your paycheck.Did you know that different types of income are taxed at different tax rates? For example, many hedge fund executives pay lower taxes than your average doctor, lawyer or teacher because of the "tax-advantaged" nature of their income.

Did you know that you can defer paying taxes by using tax-deferred accounts to save for educational expenses, a first home, medical expenses and retirement?

|

|

What you have to spend, how to buy "stuff" and how to pay for it |

You can only spend your take-home pay (your salary less all items deducted from your paycheck (e.g., withholding, payroll taxes & payments for benefits you receive from your employer). You take home pay is likely to be somewhere between 50% & 75% of your salary. When an employer offers you a salary remember that you won't get to spend all of that money. Where the employer is located and the employer's benefits policies can impact you take-home pay markedly.

Two of your biggest expenditures will be for housing & transportation. How can you put a roof over your head? Buy? Rent? Home ownership like investments in human capital has both investment and consumption characteristics. How can you get transportation? Use the T? Use a Zipcar? Lease or rent a car? Buy a car?

Once you have decided what you want to buy, you have to decide how to pay for it. Cash? Check? Debit card? Credit card? Direct debit from your checking account? An installment loan? A mortgage?

It is important that you use consumer credit responsibly. Many recent college graduates wind up with large amount of credit card debt. This is not financially sound. What you don't know about consumer credit CAN hurt you!

Your credit report & credit score determine how much consumer credit you can get & how much you will have to pay for the credit? You need to understand how your behavior affects both your credit report & your credit score?

|

|

How can your invest your savings so that you get the risk-return trade off you want? |

How you invest depends upon both your attitude to risk and on your "risk capacity". Both your attitudes and your risk capacity changes across the course of your life and your investments should change as well.

You are investing in human capital. What are the risks and return to your investment likely to be? How will returns to you human capital investment be related to returns to your other investments such as a home, stocks and bonds?

What have the risk and returns to various investments been in the past? What are the risk and returns likely to be in the future? How are return to various investments related?

You are not likely to beat the pros, but you can "win the loser's game" by carefully deciding how much to invest in different types of assets. Diversification is central to good investing! About 90% of investment returns are due to asset allocation and only about 10% of investment returns are due to asset picking (e.g., stock picking).

Tax laws offer the opportunity to defer taxes on your investments, but they generally tax deferred gains at regular income tax rates not at lower capital gains rates. In general, the time value of money indicates that you should take advantage of tax-deferral opportunities as early as possible by establishing an IRA and enrolling in your employer's 401(k) plan. What types of assets should you put in these tax-favored accounts & what types of assets should you put in your regular, taxable accounts?

What Will You Have to Do?

![]() Read and be able to discuss the

assigned

readings

Read and be able to discuss the

assigned

readings

The books for the course are: (1) Beth Kolbiner's Get a Financial Life & David Swensen's Unconventional Success. You will also be reading a number of chapters from a new book by John Authers, The Fearful Rise of Markets.

We are not using a conventional textbook because we are trying to develop a new approach to personal finance. You will read a number of items that we have developed for a multi-media presentation of a new way of thinking and learning about personal finance. Class sessions are being recorded and will become part of the materials that we are working on.

We have placed a texbook on reserve (Boone, Kurtz & Hearth's Planning Your Financial Future (4th edition, 2006)). The BKH book is readable and quite comprehensive. You may want to read chapters in this text from time to time to get background on the material that we will be covering. You should also use the textbook to look up terms or concepts that are unfamiliar to you.

![]() Complete

a set of assignments that asks you to develop a

prototype

family and answer personal finance questions for that prototype. Please review one of the prototypes developed by students in previous semester. This review should give you ideas for your own prototype and will also show you the type of assignments you will be completing during the semester.

Complete

a set of assignments that asks you to develop a

prototype

family and answer personal finance questions for that prototype. Please review one of the prototypes developed by students in previous semester. This review should give you ideas for your own prototype and will also show you the type of assignments you will be completing during the semester.

What Will Classes Be Like?

|

|

Active--You will have to participate! It is the only way to learn. |

|

|

Up-To-Date--We will make extensive use of current financial news and data. |

|

|

Hands on--Use your economics and statistics to understand personal finance |

|

|

Open Classroom--The class will have auditors & may have guest lecturers & press represenatives. |

Home Outline &Readings Description Assignments Requirements

© Ann Dryden Witte, 2006