|

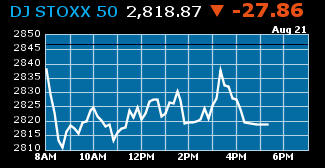

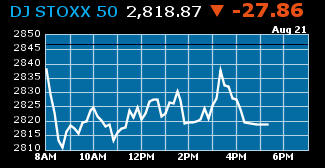

| Source: http://www.bloomberg.com/, accessed 8/21/2008 at 6:11 PM EST |

|

Econ 223

Assignment 7

(October 28)

Purpose: Estimate your family’s expenses. Compare your family's expenses to the income that you family has available to spend & invest (from line 54 of your Prototype Summary worksheet). Decide how your family pays for things (e.g., cash, debit cards, credit cards, direct debit). Decide how your family will finance things they do not pay for in full.

Resources: Kobliner Chapters 2, 3, 4, 7 & 8, Gulley & Witte presentations--Purchasing I, Purchasing Insurance (in the folder with Purchasing I) & Purchasing II in the First Class conference, the EASi Market Planner in Lexis Nexis Statistical Data Sets, Consumer Expenditure Survey and Table 706 (Cost of Living Index--Selected Metropolitan Areas) of the US Statistical Abstract. Note: Table 706 is also available in the "Purchasing I" presentation folder.

Note: Market Planner in Lexis Nexis Statistical Data Sets is the new data set that Betty showed you in her presentation. It provide expenditures and demographics by state, county, census tract, and zip code.

For this assignment, you will complete all sections of the “Expenses” worksheet using the Prototype Spreadsheet Template in the "Prototype" folder in the First Class conference as a guide & write up a description that explains your family's purchases, including how they paid for them.

Begin your spreasheet work by eliminating expenses that are not relevant to your prototype from your Expenses worksheet. Next add expenses incurred by your family that are not listed in the Expenses worksheet. Next, incorporate the Expenses worksheet in the Master spreadsheet for your family.

You will useEASI market Planner, the Consumer Expenditure Survey (CEX) and Table 706 to estimate some expenses and will actually research and make your own estimates for other expenses.

Begin by selecting (1) one "Day-to-Day Purchase" (see Slide 4 of the "Purchasing I" presentation), (2) the package of recurrent items to purchase (see Slide 5 of the "Purchasing I" presentation ) and (3) one type of "Occasional Purchase" (see Slide 6 "Purchasing I" presentation). You should actually do research to determine how much your prototype will pay for these three types of purchases & you are required to use Consumer Reports to help you decide on one purchase. Record these three purchases in your Prototype’s Expenses Worksheet (e.g., annualizing your “recurrent” purchases, as well as your “day-to-day” purchases and placing your “occasional" purchase in a relevant category (e.g., Dining Out, Personal Care Products & Services)).

For each of these three purchases, your write up should describe the family's goals for that purchase, the family's decision-making process, including how the family decided to pay for/finance the purchase, and the final cost of the purchase.

You should also do research to estimate how much your prototype will spend for housing. Enter your cost estimates for all housing items in the Expenses worksheet. Will they rent or own their own home? What housing expenses in addition to a rent or mortgage payment will they have? In your write up, you should describe your family’s goals for housing, including how they decided to pay for or finance their housing.

To estimate all other expenses for your family’s Expenses Worksheet, you may use either Lexis/Nexi's EASI Market Planner or the Consumer Expenditure Survey and Table 706 of the Statistical Abstract.

If you use EASI Market Planner, you should begin by clicking here. On the page that appears click on EASI Market Planner. Next click on "Consumer Spending Analytics". At this point, you can find expenditure by age group, income, race, home ownership or household type. You may want to combine estimates for more than one of these family characteristics (e.g., age and income). For each family characteristic, you should estimate the expenditures of your family using data for the zipcode where they live. If you have difficulty using EASI Market Planner, please see Betty Febo, the Research Librarian.

If you use the Consumer Expenditure Survey (CEX), begin by clicking here. First, you will get an estimate of expenditures for typical US families with pre-tax incomes like your prototype family from the CEX. Click here to see how to do this. Next you will adjust these estimates to reflect the cost of living in the metropolitan area where your family lives. Click here to see how to do this.

Finally, regardless of whether you use EASI Market Planner or CEX, you should apply “common sense” to your expense estimates, and make any changes necessary to better reflect your family’s spending, noting the reason for such in the “Comments” section of your expenses worksheet (e.g., a female prototype might use spa services more frequently then estimated using CEX and Table 706)

Compare your families expenditures to the income they have available to spend & invest. Can your family “afford” to spend the way they do? Calculate your family's "Investable Income" & put it in row 83 of your expenses worksheet.

Add a row named "Investable Income" after the row 54 in the Prototype Summary worksheet for your family. Link column B of this new row to the "Investable Income" number in row 83 of your expenses worksheet.

Be sure to evaluate (using the RITE system) all websites that you use except those that are obviously the place to get the information (e.g., Verizon for Verizon telephony) or are not linked to course material (including Betty's web page for the course). You should only use high quality web sites. (Not using websites is not advisable!)

Upload your draft write up, your master spreadsheet that now contains the Expenses worksheet & your RITE evaluations to the Assignment 7 folder in the Econ223-Drop conference in FirstClass before class on October 28.

Presentation & Financial Advisor Work

Email Econ223-Ask Ann & Saundra by 5PM on October 28 at the latest to request the presenter or Financial Advisor role for this week. Your presentation will be on November 5. If we do not have a volunteer presenter & Financial Advisor by 5PM on November 1, we will assign students to presenter & advisor roles.

Home Outline &Readings Description Assignments Requirements

© Saundra Gulley & Ann Dryden Witte, 2006